Are you dealing with an estate that includes shares and other assets in the USA? If the value of the US estate at the date of death exceeded $60,000 USD, you will need to obtain a Federal Transfer Certificate from the Internal Revenue Service in the USA. Known as transfer certificate Form 5173, obtaining this document involves the submission of numerous papers, including Form 706-NA and tax paperwork, to the IRS. It’s necessary to demonstrate the applicability of the relevant double taxation treaty, and it can be a lengthy and frustrating process for the uninitiated, with official guidance often opaque and confusing.

Let’s talk about the IRS form 5173 transfer certificate.

Simply stated, a 5173 form is an IRS-issued form that states that a foreign estate tax liability has been paid or settled and the investment custodian can release assets to the executor. The assets are only U.S. “situs” assets.

U.S. “situs” assets include U.S. real estate, tangible property, and U.S. stocks. Fortunately, the IRS excludes certain assets from U.S. non-resident estate taxation. U.S.-based bank accounts and bank deposits are the most commonly excluded assets.

U.S. situs assets include any U.S. stocks held in a brokerage account. To release the funds from the deceased non-resident’s account, the estate executor must provide certain documents and forms to the investment brokerage.

Once the executor files Form 706-NA, the IRS has the ability to complete an estate tax review if necessary. Once the IRS approves the return, they will subsequently issue a tax clearance certificate. The IRS will only issue transfer certificates when they determine that the estate tax (if any) has been paid.

Under U.S. tax law, a U.S. brokerage firm cannot transfer assets from the decedent’s account until they receive Form 5173 from the executor. The investment broker typically can only release or transfer the account assets once the executor, surviving joint tenant, trust beneficiary, or another person legally entitled to receive the decedent’s assets provide to the broker an original “Transfer Certificate” (IRS Form 5173) received from the IRS.

According to U.S. Treasury Regulations, estates of non-resident decedents must obtain an IRS Transfer Certificate before requesting an asset transfer from a decedent’s account.

You must file Form 706-NA to obtain IRS Form 5173. This can be a lengthy process. The IRS admits that the process can take a year or even longer.

The Form 706-NA has to be filed within nine (9) months of the date of death (although there is an automatic 6-month extension possible), as otherwise there might be penalties payable, but as we are claiming the benefit of the UK / USA Tax Treaty with the result that no US Estate Taxes are due and payable on the USA assets, we have not so far had anyone charged with such penalties even though the US IRS have the power to do so.

Most of the time we find that it is only after the time limit has passed do the Executors even know about the need to file Form 706-NA, as they will have been concentrating on obtaining the English Grant first, gathering in the assets and selling the same or distributing the same to the various Beneficiaries; and it is only after most of this has been completed that the Executor’s attention is drawn to dealing with any foreign assets (including the USA assets).

You should note that no transfer or sale of the shares can take place until we have received the Federal Transfer Certificate (Form 5173 transfer certificate) from the US IRS (at least one year away), and only after we have received the same, will we be able to undertake the Medallion Guarantee process, and then transfer the shares into the names of the Executors or into the names of the Beneficiaries entitled to receive the same.

If there is an intention to sell some or all of the shares, again this cannot be done until the shares have been transferred into the names of the Executors (which again cannot occur until the needed Federal Transfer Certificate has been obtained).

You should also note that a Federal Transfer Certificate is not required if a Grant of Probate is obtained in the USA; and is not required for companies that are not incorporated in the USA even if the company’s share registrars are based in the USA.

The IRS Transfer Certificate shows that the decedent’s estate has met its U.S. federal estate tax liability. Many investment custodians require the transfer certificate even when the assets are not subject to U.S. taxes. This is typically cash and non-U.S. securities.

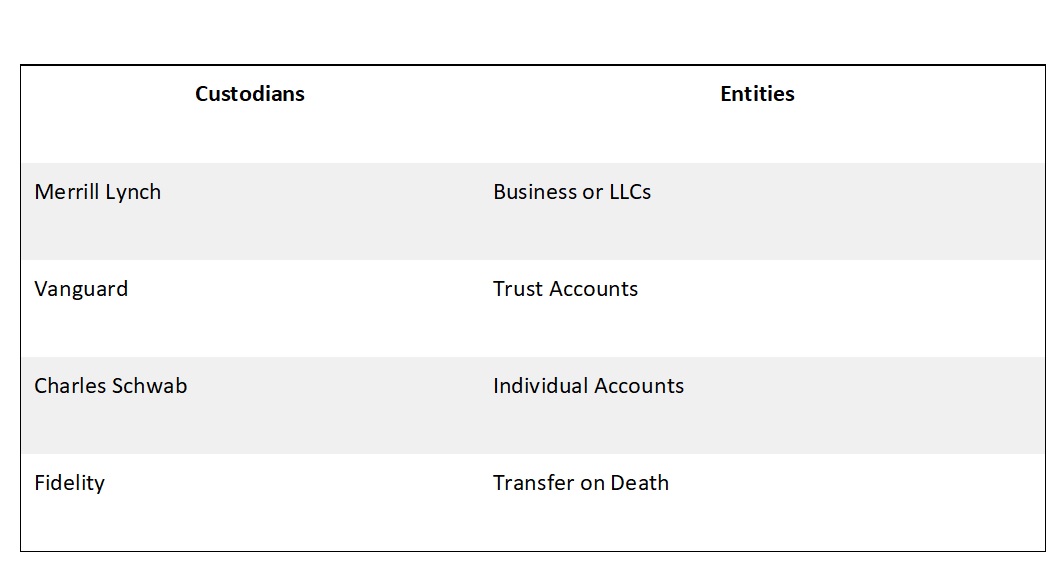

The transfer certificate requirement only applies to the following account types:

Individual Accounts

Joint Accounts

Sole Proprietors

Transfer on Death Accounts

UGMA and UTMA accounts

Conservatorship or guardian accounts

Qualified Accounts

Trust Accounts

An IRS Transfer Certificate is not required when a non-resident decedent’s estate (regardless of citizenship) is administered by a qualified executor or administrator acting within the U.S.

Form 706-NA is not required if the fair value of the decedent’s U.S. estate is less than $60,000. As such, you must submit the following items to the IRS. Make sure to include English translations and instructions if necessary:

If any of the above items are not available or not applicable make sure to include a statement describing why.

The IRS states that the time frame to process the affidavit is six to nine months from when the IRS receives all required documentation. As such, the entire process can take over a year.

You should file Form 706-NA only when required. Filing the return without the requirement can ultimately delay the issuance of the Transfer Certificate.

If the documents support that there is no need to file Form 706-NA, the IRS will issue a letter stating that the transfer certificate is not required and, accordingly, will not be issued.

Check with your financial institution for their requirements. The following are a list of investment brokerages that will typically ask a transfer certificate:

Just follow the steps below:

The executor must identify and properly value the assets. This includes stocks, mutual funds and real estate (among other items).

Most international-based executors will find it difficult to navigate U.S. tax laws. That’s where a qualified CPA and attorney can assist.

Non-resident decedent estates with net assets greater than $60,000 are subject to U.S. estate tax. If assets are greater than $60,000, Form 706-NA is required prior to the issuance of Form 5173.

Once the estate tax is paid and a closing letter is received, the executor can then request the transfer certificate form 5173. Just make sure everything is complete and accurate.

By the IRS’ own admission, it can take a minimum of 6 months to receive the legal form 5173. We have seen instances when it takes over a year. This emphasizes the need to make sure you supply accurate information upfront, so you do not prolong the process.

The following transfer certificate filing requirements apply to the estate of a decedent who was neither a citizen nor a resident of the United States and who died after December 31, 1976. A transfer certificate is not required for property administered by an executor or administrator appointed, qualified and acting within the United States.

Please read Part A and Part B and find the section that applies to the decedent’s estate. Only one section will apply. When submitting your request, please make sure to state the assets for which you are seeking a transfer certificate. For 2010 deaths, see IRS Notice 2011-66.

If the value of the decedent’s taxable assets in the United States (read the Instructions for Form 706-NA to determine which types of assets are taxable) exceeded $60,000* on the date of death, submit a copy of Form 706-NA, U.S. Nonresident Alien Estate Tax Return, together with the supporting documents specified in Form 706NA Instructions, to the following address:

Internal Revenue Service Center

Attn: E&G, Stop 824G

7940 Kentucky Drive

Florence, KY 41042–2915

File the original Form 706-NA, which is due nine months after the decedent’s date of death unless an extension of time to file was granted, at the address listed in the Instructions for Form 706-NA.

The time frame for the IRS to process an estate tax return is six to nine months. The Service will issue a transfer certificate when satisfied that the tax imposed upon the estate, if any, has been fully discharged or provided for. The tax will be considered fully discharged for purposes of the issuance of a transfer certificate when the investigation has been completed and payment of the tax, including any deficiency finally determined, has been made.

If the value of the decedent’s taxable assets in the United States (read the Instructions for Form 706-NA to determine which types of assets are taxable) was $60,000* or less on the date of death, please submit the items listed below to the following address:

Internal Revenue Service Center

Attn: E&G, Stop 824G

7940 Kentucky Drive

Florence, KY 41042–2915

If any of the above-listed items are unavailable, include a statement explaining why.

The time frame for the IRS to process the affidavit and supporting documents is six to nine months from the time the IRS receives all necessary documentation.

If Part B applies, do not file Form 706-NA. The unnecessary use of Form 706-NA will delay the issuance of a Transfer Certificate.

* Reductions must be made in this amount to reflect any adjusted taxable gifts made by the decedent after 1976.

If the documentation provided supports there is not a filing requirement, correspondence will be issued stating an IRS transfer certificate is not required and will not be issued.